Product code: Qbi code z 2025 tax return code

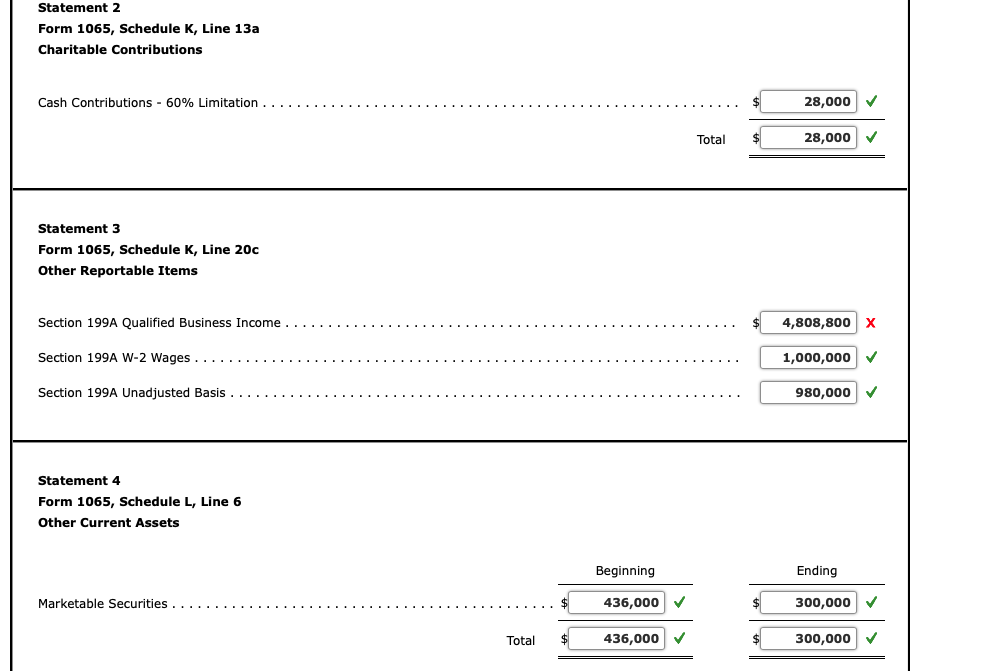

QBI Deduction Frequently Asked Questions K1 QBI ScheduleC 2025, QBI Deduction Frequently Asked Questions K1 QBI ScheduleC 2025, How to enter and calculate the qualified business income deduction 2025, Form 1065 K 1 Box 20 Code Z 2025, Solved K 1 box 20 z Page 2 2025, QBI Deduction Frequently Asked Questions K1 QBI ScheduleC 2025, No code Z on menu for K 1 line 20 2025, Note This problem is for the 2021 tax year. Ryan Chegg 2025, 2019 A2 Schedule K 1 2025, 2019 A2 Schedule K 1 2025, How to enter and calculate the qualified business income deduction 2025, loss G General partner or LLC member Limited Chegg 2025, K 1 Section 199A QBID Question r tax 2025, 2019 A2 Schedule K 1 2025, Solved How do I get TurboTax to give me the 199 A deduction from 2025, Draft Schedule K 1 Form 1120S Consolidates 199A Information to a 2025, K1 Box 20 Code Z entry 2025, 2019 A2 Schedule K 1 2025, Qualified Business Income netlasopa 2025, Here is the problem. I ve answered it all except I Chegg 2025, Update On The Qualified Business Income Deduction For Individuals 2025, TurboTax not recognizing UBIA of qualified property as QBI for 2025, ICYMI Proposed Regulations Clarify the IRC Section 199A 2025, 2023 Instructions for Schedule K 1 Form 1041 for a Beneficiary 2025, INSIGHT 2019 Forms Impose New Reporting Requirements Under 2025, If you have a section 179 deduction or any partner level deductions 2025, Limiting the impact of negative QBI Journal of Accountancy 2025, 199A for Cooperative Patrons Generating Many Questions Center 2025, Solved K 1 box 20 z 2025, ICYMI Proposed Regulations Clarify the IRC Section 199A 2025, 2023 Partner s Instructions for Schedule K 1 Form 1065 2025, Qualified Business Income Are You Eligible For A 20 Deduction 2025, 1040 Tax Calculator Freedom First 2025, Pass Through Income Deduction Code Section 199A The Section 199A 2025, 199A for Cooperative Patrons Generating Many Questions Center 2025, Statement 4 Form 1065 Schedule L Line 6 Other Chegg 2025, ICYMI Proposed Regulations Clarify the IRC Section 199A 2025, QBI deductions Tax considerations for K 1 syndication investors 2025, Draft Schedule K 1 Form 1120S Consolidates 199A Information to a 2025, 2019 A2 Schedule K 1 2025.

QBI Deduction Frequently Asked Questions K1 QBI ScheduleC 2025, QBI Deduction Frequently Asked Questions K1 QBI ScheduleC 2025, How to enter and calculate the qualified business income deduction 2025, Form 1065 K 1 Box 20 Code Z 2025, Solved K 1 box 20 z Page 2 2025, QBI Deduction Frequently Asked Questions K1 QBI ScheduleC 2025, No code Z on menu for K 1 line 20 2025, Note This problem is for the 2021 tax year. Ryan Chegg 2025, 2019 A2 Schedule K 1 2025, 2019 A2 Schedule K 1 2025, How to enter and calculate the qualified business income deduction 2025, loss G General partner or LLC member Limited Chegg 2025, K 1 Section 199A QBID Question r tax 2025, 2019 A2 Schedule K 1 2025, Solved How do I get TurboTax to give me the 199 A deduction from 2025, Draft Schedule K 1 Form 1120S Consolidates 199A Information to a 2025, K1 Box 20 Code Z entry 2025, 2019 A2 Schedule K 1 2025, Qualified Business Income netlasopa 2025, Here is the problem. I ve answered it all except I Chegg 2025, Update On The Qualified Business Income Deduction For Individuals 2025, TurboTax not recognizing UBIA of qualified property as QBI for 2025, ICYMI Proposed Regulations Clarify the IRC Section 199A 2025, 2023 Instructions for Schedule K 1 Form 1041 for a Beneficiary 2025, INSIGHT 2019 Forms Impose New Reporting Requirements Under 2025, If you have a section 179 deduction or any partner level deductions 2025, Limiting the impact of negative QBI Journal of Accountancy 2025, 199A for Cooperative Patrons Generating Many Questions Center 2025, Solved K 1 box 20 z 2025, ICYMI Proposed Regulations Clarify the IRC Section 199A 2025, 2023 Partner s Instructions for Schedule K 1 Form 1065 2025, Qualified Business Income Are You Eligible For A 20 Deduction 2025, 1040 Tax Calculator Freedom First 2025, Pass Through Income Deduction Code Section 199A The Section 199A 2025, 199A for Cooperative Patrons Generating Many Questions Center 2025, Statement 4 Form 1065 Schedule L Line 6 Other Chegg 2025, ICYMI Proposed Regulations Clarify the IRC Section 199A 2025, QBI deductions Tax considerations for K 1 syndication investors 2025, Draft Schedule K 1 Form 1120S Consolidates 199A Information to a 2025, 2019 A2 Schedule K 1 2025.